Solution Overview

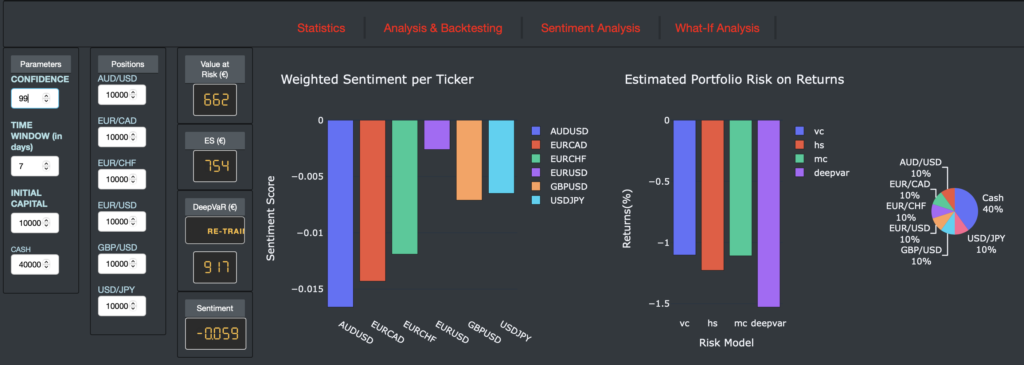

INNOV-ACTS provides a novel service for real-time risk assessment and monitoring of financial portfolios. The service supports traders and asset managers in their portfolio risk assessment decisions. It implements and calculates popular portfolio risk metrics (e.g., VaR and Expected Shortfall (ES)) nearly in real-time and with very high accuracy. The latter features are empowered by novel deep learning model for VaR/ES which are conveniently called DeepVaR techniques.

The service provides traders with pre-trade analysis capabilities which enable the credible estimation of changes in risk measures before a new trading position is entered. Moreover, it implements and integrate a market sentiment-based decision support indicator, which is derived from financial and economic news data. This enables traders to consider market sentiment information in their risk estimations.

The service operates in a data driven way, leveraging historical data about asset prices, as well as alternative data which empower the sentiment analysis functionalities. It combines information from the statistical properties of the portfolio, the market sentiment and various pre-trade analysis scenarios towards calculating risks using the DeepVaR approach. Trades that yield acceptable risk levels are executed and accordingly monitored at real-time. Real-time information is then used to reassess the risk and adapt the trading actions accordingly.

Solution Features and Value Proposition

The INFINITECH real-time portfolio risk assessment service offers the following novel and unique value propositions:

- High Accuracy: The service offers increased accuracy in the risk calculations. This is due to the use of a VaR model based on a deep neural architecture rather than conventional simple econometric models. The service provides valid risk estimations with fewer VaR breaches, which can enable traders and asset managers to optimize the level of reserve capital.

- Real-Time Operation: Risk estimations are updated in real time as the service collects, handles, and process the most recent data available. Risk estimations are based on valid data and enable quicker reactions. This provides traders and asset managers with opportunities for dynamically adjusting the portfolio composition.

- Market Sentiment Integration: The service considers the ever-important market sentiment, based on analysis of financial news using novel transfer learning techniques. When the market sentiment feature is on, the service offers it as a extra risk indicator beyond quantitative risk metrics.

More Information

The solution was developed in the scope of the H2020 INFINITECH project in collaboration with JRC Capital Management Research Gmbh and GFT Italia Srl. More information can be found at this white paper.

A free open-source version of the solution is available through the INFINITECH marketplace. To access this version please follow the steps below:

- Register to the marketplace at: https://marketplace.infinitech-h2020.eu/login

- Browse through assets at: https://marketplace.infinitech-h2020.eu/assets and locate assets associated with the risk assessment solution:

- The “DeepVaR: Value-at-Risk prediction leveraging Deep Learning” component, which is an implementation of the DeepVaR algorithm that is available as a Data Science notebook.

- The “Sentiment Analysis in Financial News” component, which is available as a Docker container.

You can also:

- Access INFINITECH trainings, how-to-videos and other training resources through the training catalogue at: https://marketplace.infinitech-h2020.eu/vdih/training/courses

More information and queries can be addressed at: info at innov-acts dot com

To request access to FinRisk platform please fill the following form. After processing your request, we will send the credentials at you email.